The EPV Litmus Test: Separating Value from Hype (1 of 2)

While other valuation methods might have you performing daring acrobatics with growth projections and DCF, Earnings Power Value (EPV) keeps you grounded.

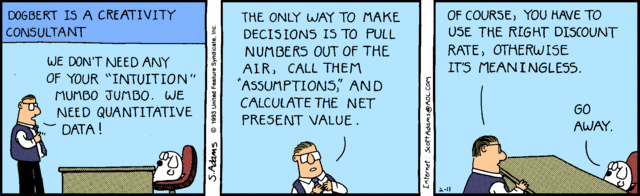

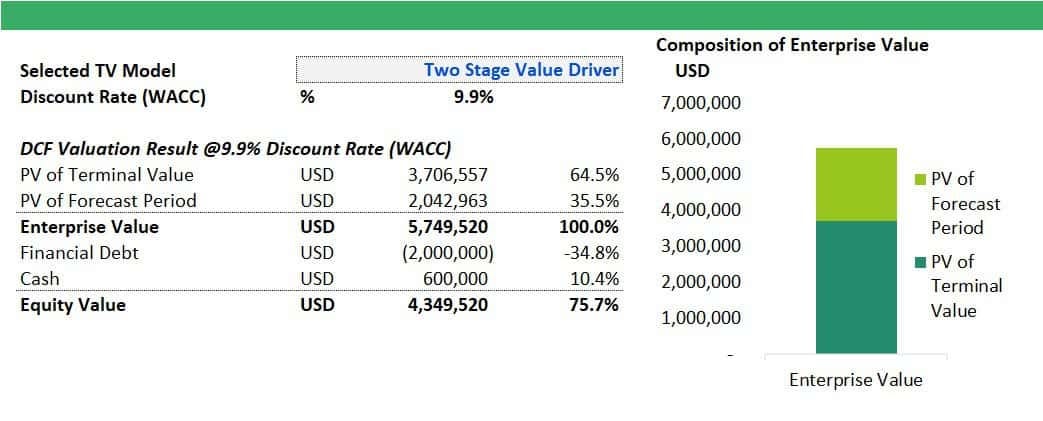

I was disappointed to discover while performing the discounted cash flow (DCF) analysis that a significant portion of a company's value in these models often comes from the terminal value. This terminal value represents the cash flows expected beyond the explicit forecast period. Usually, it accounts for 60-80% of the total value calculated.

There are two main implications to consider:

Adjusting the terminal growth rate can easily manipulate the total value you want to achieve. This can lead to various biases from the valuer's perspective and may even result in fabricating short-term results to justify a future growth rate. For instance, it can be disheartening to discover that the company's growth rate for the past year cannot sustain the growth rate it achieved over the last three years, resulting in an estimated decrease of 30-50%.

There’s an assumption that the company will continue to grow in line with industry growth rates or any growth rate you incorporate into your Discounted Cash Flow (DCF) calculation for terminal value. Ultimately, no one really knows how the company will grow over time. While it may be straightforward to base the terminal growth rate on industry growth, the key assumption is that the company in question can at least match that growth. This often does not hold, particularly in the tech industry, as illustrated by the case of Kodak, which turned out to be a value trap.

Unmasking Value Traps

·"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett

Introducing another approach: Earnings Power Value.

In the frothy world of stock markets, EPV acts as a litmus test, helping investors distinguish genuine value from mere hype. EPV cuts through the noise of market sentiment and growth stories by focusing on current earnings power. It's like having a reliable pH strip that turns one color for undervalued stocks and another for overvalued ones, helping you make more informed investment decisions.

I. Definition

Earnings Power Value is a valuation method Columbia Business School professor Bruce Greenwald developed.

It's designed to estimate a company's intrinsic value based on its current earnings capacity, assuming these earnings remain constant in perpetuity. This approach offers a more conservative perspective on a company's worth, focusing on sustainable earnings rather than speculative growth projections.

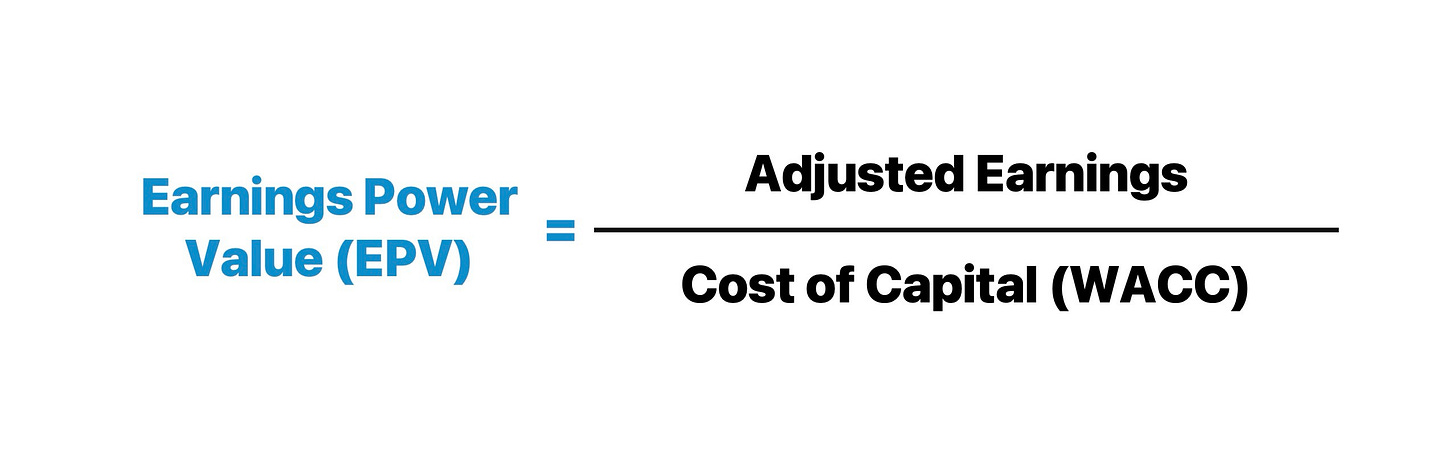

The fundamental principle of EPV lies in its simplicity and focus on present earnings. It's calculated by dividing a company's adjusted earnings by its cost of capital. The formula can be expressed as:

This method is unique for several reasons:

Conservative Valuation: EPV provides a more cautious estimate of a company's value by disregarding potential future growth. This can help investors avoid overpaying for stocks based on optimistic growth expectations that may not materialize.

Emphasis on Current Performance: By focusing on a company's current earnings power, EPV offers insights into the firm's ability to generate sustainable profits under existing conditions.

Simplicity: Compared to more complex valuation methods like Discounted Cash Flow (DCF), EPV requires fewer assumptions and projections, potentially reducing the margin for error in valuations.

Comparative Analysis: Investors can use EPV to compare a company's intrinsic value against its market price, helping identify potentially undervalued or overvalued stocks.

However, it's important to note that EPV has limitations. It is not a “one size fits all” valuation method.

It may undervalue companies with solid growth prospects or those reinvesting heavily in future expansion. Additionally, it assumes earnings stability, which may not hold true for all businesses or industries. Let’s explore its characteristics more below.

II. Characteristics of EPV

The Earnings Power Value (EPV) method has key characteristics that separate it from other valuation methods, making it a robust valuation tool for investors:

Conservative and Reliable Valuation

EPV focuses on current earnings power rather than speculative future growth, offering a conservative estimate of a company's value. This approach aligns with value investing principles, minimizes speculation, and reduces reliance on subjective assumptions such as future growth rates or cash flow projections.

Straightforward and Practical

The EPV method is simpler than other valuation techniques, like Discounted Cash Flow (DCF), requiring fewer inputs and assumptions. Its straightforward calculation makes it easy to implement and understand, making it a practical tool for investors at all levels.

Emphasis on Sustainability

EPV is particularly useful for assessing mature, stable businesses with predictable cash flows by highlighting its ability to generate consistent and sustainable earnings. This focus also helps identify companies with strong competitive advantages or economic moats that ensure long-term profitability.

Reality Check and Risk Mitigation

EPV provides a baseline valuation rooted in current financial performance, acting as a reality check against more optimistic valuation methods. Its conservative nature inherently builds a margin of safety into investment decisions, helping to mitigate downside risk and identify potential overvaluations.

Best Fit for Stable Industries

This method is especially effective for companies in mature industries with consistent earnings patterns, making it an ideal tool for valuing businesses with predictable financial performance.

By combining simplicity with a focus on sustainable earnings, EPV provides investors with a disciplined framework for assessing value and making informed decisions.

While EPV isn't perfect and may undervalue high-growth companies or those with significant future potential, it offers a valuable perspective that can enhance an investor's overall valuation toolkit. Its focus on current, demonstrable earnings power provides a grounded approach to valuation that complements other methods and helps investors make more informed decisions.

III. How does it differ from DCF?

The Earnings Power Value (EPV) and Discounted Cash Flow (DCF) methods differ in key aspects, primarily their focus, underlying assumptions, and complexity.

Focus and Approach

EPV centers on a company’s current earning capacity, assuming no growth in its operations. It provides a conservative estimate of value by evaluating a business based solely on its ability to sustain existing earnings. This approach suits mature or stable companies with predictable cash flows.

In contrast, DCF emphasizes a business's future potential by projecting its cash flows over time. These projections are discounted to the present to estimate the company's intrinsic value. The focus is on long-term growth and profitability, making it ideal for evaluating high-growth companies or dynamic industries.

Assumptions About Growth

The EPV method assumes no growth, meaning it does not account for potential future expansions or declines. This simplifies the valuation process and removes the uncertainty of predicting growth rates. As a result, EPV is less speculative and focuses on what is observable today.

DCF, however, explicitly factors in future growth by requiring forecasts for revenue, expenses, and cash flows over a specified period. While this allows DCF to capture a company’s growth trajectory, it introduces a higher degree of subjectivity and reliance on precise forecasting, which can lead to errors if assumptions are overly optimistic or flawed.

Complexity and Required Inputs

EPV is simpler and requires fewer inputs, such as current normalized earnings, the cost of capital, and adjustments for one-off items like non-operating assets or liabilities. Its straightforward nature makes it easier to implement and less prone to user error.

DCF, on the other hand, is more intricate. It demands detailed data on future cash flows, terminal value assumptions, and discount rates. This complexity can provide a deeper analysis but also requires greater expertise and introduces room for error, especially in scenarios with uncertain cash flow patterns or volatile industries.

Many analysts use both the Earnings Power Value (EPV) and Discounted Cash Flow (DCF) methods together to achieve a more comprehensive understanding of a company's value. EPV offers a conservative baseline valuation, while DCF factors in potential future growth. I prefer to use both methods to make more informed decisions by balancing current performance with future prospects.

IV. When to apply EPV?

I’ve often found the Earnings Power Value (EPV) method to be a more reliable tool than Discounted Cash Flow (DCF) in specific scenarios. While DCF can offer valuable insights, its reliance on future projections often introduces risks, particularly in uncertain or volatile conditions. By focusing on a company's current earning power, EPV provides a pragmatic, grounded approach that shines in certain contexts.

EPV is particularly effective in evaluating businesses within mature and stable industries. Think of sectors like utilities, consumer staples, or well-established manufacturing firms—industries characterized by predictable cash flows and steady performance. Unlike DCF, which projects far into the future, EPV hones in on what’s happening now, making it a perfect match for businesses where growth may be incremental, but stability is a hallmark.

Cyclical businesses, where earnings fluctuate with economic conditions, also benefit from EPV's approach. Rather than attempting to predict the highs and lows of future cycles, EPV normalizes earnings to present a balanced view of a company’s sustainable earning power. This makes it an invaluable tool for sectors like commodities, where boom-and-bust cycles can skew long-term forecasts.

In industries facing disruption or companies experiencing significant changes, such as regulatory upheaval or technological shifts, EPV’s simplicity becomes a strength. Making accurate long-term projections in such scenarios is incredibly challenging, often rendering DCF impractical. EPV sidesteps this issue by focusing solely on the here and now, providing clarity in otherwise murky waters.

For value investors, EPV is a natural fit. Its conservative approach aligns with the principle of seeking a margin of safety, ensuring investments are grounded in sustainable earnings rather than speculative growth. This mindset is especially important when evaluating companies undergoing turnarounds or restructuring, as EPV reveals its core earning potential once temporary challenges are resolved.

Whether you’re navigating volatile markets, analyzing cyclical industries, or comparing companies at different growth stages, EPV offers a pragmatic, no-nonsense framework. It’s not just a valuation method—it’s a way to stay grounded and focused in a world full of uncertainties and hype.

However, it's crucial to remember that no single valuation method is perfect. EPV's strength lies in its conservatism, but this can also be its weakness, particularly for companies with genuine high-growth potential or valuable intangible assets. The key is to use EPV in conjunction with other methods like DCF. This multi-faceted approach provides a more comprehensive view of a company's value.

As Warren Buffett once said, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." EPV helps ensure you're not overpaying, but it shouldn't be the only tool in your valuation toolkit.

And the important question is: How do you apply one?

Stay tuned for my next post!