Global Payments Inc. (GPN): A value trap or a hidden gem?

GPN saw a sharp decline in 2024 amid missed margin targets and increased competition. Despite 6% revenue and 12% EPS growth in Q3, questions remain on whether GPN is a value trap or undervalued.

This information is based on sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the author and are subject to change without notice.

You are advised to discuss your investment options with a qualified financial advisor to determine if any investment is suitable for your specific needs and risk tolerance.

Disclosure:

- I may hold positions in the securities covered in the articles on this website.

- Past performance is not indicative of future results.

- All investments involve risk, including the potential loss of principal.

Please note that this disclaimer is not a substitute for personalized financial advice and should not be considered a recommendation to buy or sell any security.

I. Background

Global Payments Inc. (GPN) came onto my radar after its fall in August 2024. Looking back, the stock has not gone anywhere since 2023. It fluctuated between $100 and $140 per share. Meanwhile, EPS has continued to increase since 1H 2023. Is this a gem or a value trap?

Looking back, Global Payments Inc. (GPN) stock has experienced a significant decline in 2024 due to several factors:

Macroeconomic concerns: Investor fears about a slowing economy potentially weighing on payment processing companies have impacted GPN's stock price. As a fintech enterprise providing payment technology and software solutions, Global Payments is sensitive to broader economic trends.

Missed expectations and communication issues: The stock experienced a 20% decline following its Q1 2024 earnings announcement. This drop was attributed to unmet margin growth targets and inadequate communication from management toward shareholders. The lack of transparency regarding cash flow disclosures and the omission of critical performance slides during presentations have eroded investor confidence.

Competitive pressures: While Global Payments maintains a strong position in certain specialized markets, it faces intense competition in its Merchant Solutions division, particularly from newer entrants like Adyen and Stripe.

It's worth noting that despite these challenges, Global Payments reported solid Q3 2024 results, with adjusted net revenue growth of 6% and adjusted EPS growth of 12%. The company has also reaffirmed its 2024 outlook, which may help stabilize the stock price going forward.

In this post, I will use the framework from my previous post to explore whether this stock is a value trap. You can check out my previous post about the value trap below!

Unmasking Value Traps

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett

II. Origin

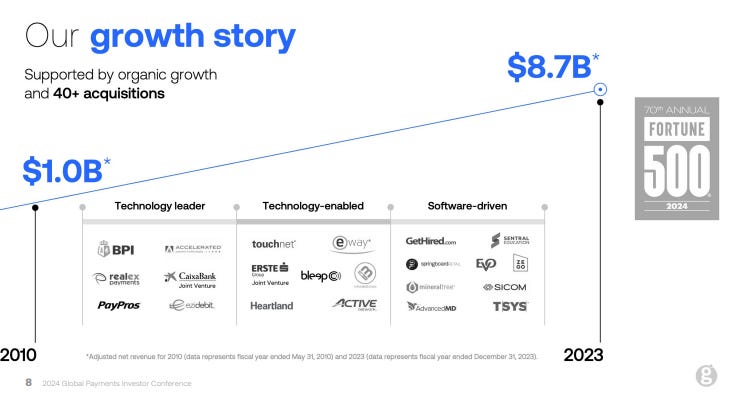

The company's journey to becoming Global Payments Inc. (GPN) involved several transformations. It wasn't until 2000 that the company officially adopted the name Global Payments Inc., marking a significant milestone in its corporate identity. This rebranding reflected the company's growing focus on payment processing and its ambitions to expand globally.

Throughout the 2000s and 2010s, Global Payments embarked on an aggressive growth strategy, primarily through strategic acquisitions and expansions into new markets. In 2009, the company made its first significant international move by acquiring United Card Service, Russia's leading credit card processing company, for $75 million. This was followed by further expansion of United Card Service in 2011 when it acquired Alfa-Bank's credit card processing unit. However, in 2022, GPN sold the United Card Service to Russia’s investment group led by Vladimir Potanin, Russia’s richest businessman and a close ally of Vladimir Putin. GPN decided to sell its Russia business because of the sanctions imposed in April 2022.

The company continued its acquisition spree in the following years. Notable purchases included Accelerated Payment Technologies for $413 million in 2012, Australian payment processing company Ezidebit for $305 million in 2014, and Irish-based payments gateway services company Realex Payments for €115 million in 2015. These acquisitions helped Global Payments diversify its service offerings and expand its geographical footprint.

A major turning point came in 2016 when Global Payments completed the acquisition of Heartland Payment Systems for $4.3 billion. This deal significantly boosted the company's market position in the United States. The growth continued with the acquisitions of divisions of Active Networks in 2017 and AdvancedMD in 2018, further expanding the company's portfolio of services.

Just recently, GPN sold AdvancedMD to Fransisco Partners for $1.13 billion as it slimmed down to focus on its core operations. GPN bought AdvancedMD in a $700 million deal in 2018. Founded in 1999, AdvancedMD provides payments and other software services to independent physicians and small- to medium-sized healthcare facilities in the U.S.

In 2019, Global Payments announced its largest merger to date, a $21.5 billion deal with TSYS. This merger was a transformative move that significantly expanded the company's scale and capabilities in the payment technology sector. Interestingly, there were reports of a potential even more significant merger with FIS (estimated at around $70 billion) in 2020, but this deal fell through at the last minute.

III. Investment Rationale

Instead of explaining my investment thesis as I usually do, I will answer my question early in this post using the framework I introduced in my previous post. So, let’s dive in!

1. Profit Consistency: Increasing revenue while maintaining stable profit margins

Global Payments Inc. (GPN) has demonstrated solid profitability and consistent profit growth over the past five years. From 2019 to 2023, the company's net income has shown a steady upward trend, with a compound annual growth rate (CAGR) of 23.85%. This robust growth in profitability is particularly impressive given the challenges posed by the global pandemic during this period.

The company's revenue has also grown consistently, with a 5-year CAGR of 22.72%, indicating that strong top-line performance supports profit growth. GPN's ability to maintain profit growth in line with revenue growth suggests effective cost management and operational efficiency. The company's adjusted operating margin has remained relatively stable, expanding by 40 basis points to 43.5% in Q1 2024, further demonstrating its ability to maintain profitability while scaling operations.

Regarding the quality of earnings, Global Payments has shown several positive indicators. The company's free cash flow generation has been strong, with projections suggesting over $10 per share in FCF for 2024 and 2025. This robust cash flow generation supports the sustainability of the company's earnings and indicates high-quality profits. Additionally, GPN's consistent performance across its various segments, particularly the strong growth in its Merchant Solutions division, suggests that earnings are derived from core operations rather than one-time gains or accounting manipulations.

2. Industry Comparison: Expanding at a rate that matches the industry while offering more appealing multiples

Global Payments Inc. (GPN) operates in a highly competitive fintech landscape, facing competition from both traditional payment processors and newer, more agile fintech companies. Compared to its peers, including Fiserv, FIS, Adyen, Jack Henry, PayPal, Broadridge Financial Solutions, and Paychex, GPN shows some interesting financial metrics and market positioning.

From a financial metrics perspective, GPN appears to offer good value compared to many of its competitors. Its PE ratio (TTM) of 18.92 is the lowest among the compared companies, with Adyen at 52.85, Jack Henry at 35.02, PayPal at 18.94, FIS at 67.20, and Fiserv at 38.43. While GPN's PEG ratio 1.26 may not be the lowest, it is still comparable to Paypal's, indicating room for growth for both players. Broadridge Financial Solutions and Paychex, while not direct competitors in all aspects, have PE ratios of 36.26 and 30.15, respectively, still higher than GPN.

Although GPN's Price/Free Cash Flow (FCF) ratio is higher than that of PayPal, at 16.88 compared to 12.79, GPN's 1-Year EBITDA Growth rate is also higher, at 30.00 versus PayPal's 21.70. This suggests that GPN has opportunities to further improve its FCF, making its stock appear more attractively priced.

Overall, it appears that GPN aligns closely with its peers in terms of growth rates. The median 1-Year Revenue Growth Rate (Per Share) for peers is 7.3%, while GPN's rate stands at 9.7%, indicating comparable performance. Additionally, GPN's 1-Year EBITDA Growth Rate is similar to the market average of 30.0%, with GPN's rate recorded at 29.53%.

In terms of market share and transaction volume, GPN ranks among the top players in the industry, though it trails behind Fiserv and FIS. According to recent data, Fiserv has taken the lead as the largest non-bank merchant acquirer, handling 35.38 billion transactions worth $2.03 trillion in 2022, while FIS's Worldpay unit processed 31.42 billion transactions worth $1.66 trillion.

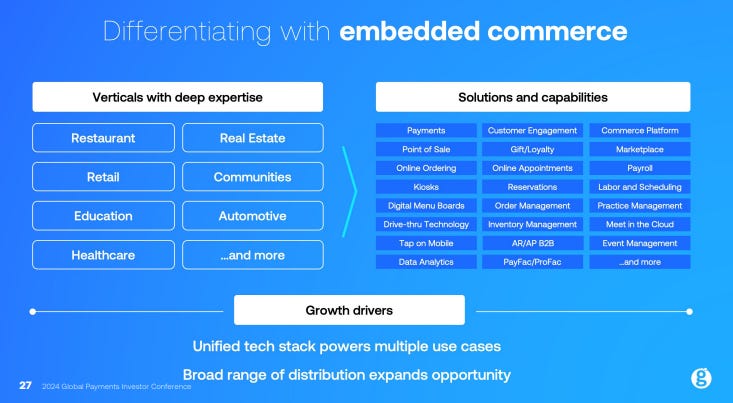

3. Future Planning: One-stop payment processing solution for SMBs across various verticals

Global Payments Inc. (GPN) has laid a comprehensive plan focusing on strategic growth, operational transformation, and technological innovation. This plan is crucial for the company's longevity in the rapidly evolving fintech and payment processing industry.

At its core, GPN aims to become the worldwide partner of choice for commerce solutions, unifying its Merchant Solutions business globally and harmonizing POS solutions under the Genius brand. This strategy will help create a more cohesive and recognizable brand identity, potentially strengthening GPN's market position and customer loyalty.

A key focus of GPN's future strategy is on small and medium-sized businesses (SMBs), delivering a full suite of software and commerce enablement solutions. This emphasis on a growing market segment could provide GPN with a stable revenue stream and opportunities for expansion. Simultaneously, the company plans to capitalize on growth in its Issuer Solutions segment by leveraging cloud modernization and cross-selling initiatives, which could help the company stay technologically relevant and increase its market share in the issuer services space.

Operational transformation is another critical component of GPN's future plan. The company is implementing initiatives to unlock over $500 million of adjusted run-rate operating income benefits by early 2027. This focus on efficiency and cost-saving measures could significantly improve GPN's profitability and competitiveness in the long term. Additionally, GPN is actively expanding its presence in various sectors, including sports and entertainment, as demonstrated by recent partnerships with Diamond Baseball Holdings and UK football clubs. Diversifying into high-volume transaction environments could provide resilience against potential slowdowns in other sectors.

From a financial perspective, GPN has set ambitious targets. The company aims to return $7.5 billion to shareholders over the next three years, demonstrating a commitment to shareholder value that could help maintain investor confidence and support the stock price. For the medium term (2025-2027), GPN has set targets for mid-single-digit to high-single-digit adjusted net revenue growth, 50-100 basis points of adjusted operating margin expansion, and low-teens adjusted EPS growth. These targets provide a clear roadmap for financial performance and growth.

4. Management Quality: Implementing a new direction will take time to show results

Global Payments Inc. (GPN) underwent a significant management change in 2023 with the appointment of Cameron M. Bready as the new CEO. This transition was part of a planned succession strategy, with Bready taking over from Jeffrey S. Sloan on June 1, 2023. The change came at a pivotal time for the company, following the completion of its acquisition of EVO Payments and the divestiture of its Netspend consumer and gaming solutions businesses.

The management team at GPN has performed admirably, achieving a compound annual growth rate (CAGR) of 17% for adjusted net revenue and 16% for adjusted earnings per share (EPS).

However, they are not without challenges.

Recent changes in leadership, with CEO Bready taking a different direction than the previous CEO, Sloan, have raised some concerns. This shift is reflected in a recent statement made by Brady in a press release.

“Pursuing dispositions of select assets to accelerate value creation.

Streamlining and simplifying business through our operational transformation to unlock substantial value and support sustainable growth”.

I wholeheartedly support the effort to streamline services, as there are several overlapping solutions. However, untangling the acquisitions made over the last 13 years may take some time. It will be interesting to see how this process affects GPN’s earnings per share (EPS) in 2025. Given the strong competition in a challenging market, it is crucial for GPN to prioritize scaling its operations rather than addressing overlapping services.

5. Financial Health: Improving FCF/share

The company’s strong free cash flow generation is a key indicator of its financial strength. With a recorded free cash flow per share of $6.08, the company has consistently increased its free cash flow through effective management of net working capital and net income growth. This robust cash flow generation supports the company’s ability to invest in growth initiatives, manage debt, and return capital to shareholders.

As of the latest available data, Global Payments had a debt-to-equity ratio of 0.82. While this is higher than some of its competitors, it's not alarmingly high for a company in the financial technology sector. The company's strong cash flow generation should allow it to manage this debt level effectively.

6. Competitive Position: A successful series of acquisitions aimed at addressing the needs of long-tail users

I appreciate that the company is acquiring other payment processors in this space. A company must make strategic acquisitions in an industry where scale is crucial to survive competition and thrive. We have seen companies like Constellation Software successfully acquire SaaS businesses that operate in niche markets, strengthening their portfolios by providing best practices to these acquired companies.

I observe a similar strategy at GPN. In the last five acquisitions made by management, a common theme has been market expansion and capability enhancement, both of which are important for growth.

One notable acquisition was Takepayments in 2024, which enabled GPN to expand its services internationally to small and medium-sized businesses (SMBs) in the UK. Additionally, acquiring EVO Payments Inc. allowed GPN to enter new markets, including Poland and Germany. The acquisition of TSYS provided GPN with the capabilities necessary to streamline its integrated payments system, resulting in faster transaction times and higher authorization rates.

Below, I will explain the rationale behind GPN's last five acquisitions:

Takepayments (2024):

Deal value: $250.0 million

This acquisition allows Global Payments to expand its international footprint, particularly in the UK small business sector. It capitalizes on Takepayments' robust distribution channel, enhancing Global Payments' payment technology offerings and operational efficiencies for diverse businesses.EVO Payments Inc. (2023):

Deal value: $4.0 billion

This strategic acquisition expands Global Payments' geographic footprint into new markets such as Poland, Germany, and Chile. It significantly increases B2B software capabilities and enhances the company's financial scale, with expected synergies benefiting both companies' customer bases.TSYS (Total System Services) (2019):

Deal value: $21.5 billion

This merger created a technology-enabled payments company with extensive scale and global reach. It enhances capabilities in integrated payments, creates efficiencies for businesses and financial institutions, and allows for faster transactions and higher authorization rates. The combined company serves approximately 3.5 million merchants and provides enhanced solutions in eCommerce and omnichannel contexts.Cayan (2017):

Deal value: $1.05 billion

This acquisition allowed TSYS (now part of Global Payments) to expand its market share and enhance payment solutions for small and medium-sized businesses. It was expected to modestly increase TSYS's net revenue growth and adjusted diluted earnings per share. The acquisition also strengthened TSYS's portfolio by integrating Cayan's innovative payment technologies, including its Genius platform.AdvancedMD (2018):

Deal value: $700.0 million

This acquisition allowed Global Payments to expand its footprint in the healthcare vertical market. It integrated AdvancedMD's cloud-based enterprise software solutions, enhancing Global Payments' technology-enabled payments strategy. This move was expected to drive revenue growth and leverage the fragmentation in the healthcare sector, strategically positioning Global Payments to address a broader market opportunity.

While ideally, these acquisitions made sense on paper, we must also analyze these acquisitions and their effect on GPN’s finances. I use EPS as a proxy of how accretive all these acquisitions are. Although there are a lot of factors that can influence one company’s EPS in a period, but we can assume that the effect of these acquisitions would be material and should be reflected in GPN’s EPS. To reduce the noise, I use EPS without NRI (Non-Recurring Income) to better analyze the effect of acquisitions and take out one-off items.

Looking at the result above, GPN’s EPS continuously grew from $2.14 per share in 2020 to $4.20 per share in 2024. While I cannot say that all these improvements were due to accretive acquisitions, it surely looks good that GPN's EPS continued to grow amid these acquisitions, and it shows how successful they are as serial acquirers.

IV. Conclusion

Global Payments Inc. (GPN) emerges as a hidden gem rather than a value trap in the fintech and payment processing industry. The company's strong financial performance, with a net income CAGR of 23.85% and revenue CAGR of 22.72% from 2019 to 2023, coupled with attractive valuation multiples compared to peers, positions it favorably for long-term growth. GPN's strategic focus on becoming the worldwide partner of choice for commerce solutions, particularly for SMBs, along with its operational transformation targeting over $500 million in adjusted run-rate operating income benefits by 2027, demonstrates a clear path for future expansion. Under new CEO Cameron M. Bready, the company is streamlining its business while maintaining strong free cash flow generation and a manageable debt-to-equity ratio. GPN's successful track record of strategic acquisitions, including Takepayments, EVO Payments Inc., and TSYS, has expanded its capabilities and geographic footprint, contributing to consistent EPS growth from $2.14 in 2020 to $4.20 in 2024. While challenges exist, such as intense competition and the need to effectively integrate recent acquisitions, GPN's overall profile suggests significant potential for long-term value creation in the dynamic fintech industry.

Nice post! Thanks!