Macy's Dilemma: Should They Break Up or Not?

Macy's is grappling with a tough retail climate and facing pressure from activist investors. With valuable real estate assets, should Macy's consider selling them?

I. Executive Summary

Amidst a retail landscape marked by slower growth, Macy's is holding its ground, albeit with a decline in revenue. Recognizing the saturated market, Macy should wait for the perfect partner to reignite growth.

Despite performance on par with competitors like Nordstrom, Macy's brand remains a key asset, particularly in attracting digitally native customers.

Unlocking value from properties presents an opportunity, albeit tricky, given current market dynamics. While Macy's valuation is close to industry comparables, proactive management is needed to find new avenues for growth.

With favorable financials and improving macroeconomic conditions, Macy's management has the luxury of time to craft a strategic approach. With industry growth projected at 5% over the next three years, Macy's decision to wait for the right partner seems prudent. This will allow for a more thoughtful and impactful strategy to emerge and extract more value from its position in the market and its asset value.

II. History of Macy’s, Inc.

Macy's is a prominent department store chain in the United States. It operates under the Department Store category, which is the oldest and often largest place for consumers to shop for various products under one roof. Department stores like Macy's typically offer a wide range of products, including clothing, accessories, home goods, and more.

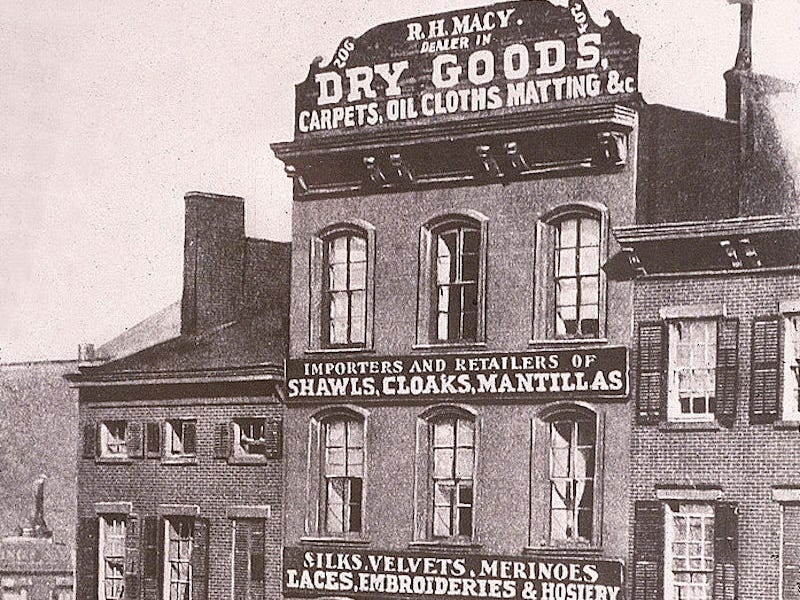

The company was founded by Rowland Hussey Macy in 1858 in New York City. Before establishing his store, Macy worked on a whaling ship and later managed his father's store in Massachusetts. He attempted to open several dry goods stores in Boston and other locations, but they failed until he opened his iconic store in New York City.

The original store, "R. H. Macy & Co.," was located on the corner of 14th Street and 6th Avenue. It started with a modest $11.08 in sales on its first day of business in 1858. Macy expanded his business by opening more departments and using innovative marketing strategies, including elaborate window displays and themed exhibits. He also introduced the concept of a one-price system and offered a money-back guarantee, which was revolutionary at the time.

Macy's is credited with creating the modern department store as we know it today. He introduced various innovations such as onsite tailoring, dining, and "window shopping" through elaborate holiday window displays. After Macy died in 1877, the store was managed by his partners until it was acquired by the Straus family in 1885. The Straus family moved the store to Herald Square in 1902, where it became an iconic location in popular culture. By the mid-20th century, Macy's had expanded nationally, opening branch stores and acquiring local department store chains across the country.

III. Financial Updates

Despite its iconic status, Macy's has faced significant challenges in recent years due to the retail apocalypse and shifting consumer preferences. Despite the industry being expected to continue growing at 12.2% in 2021, the company has announced plans to close stores and undergo a major business overhaul.

Macy's reported a decline in comparable owned-plus-licensed sales, with a 6.3% decrease on a 52-week basis for the third quarter and a 6.0% decrease for the full year 2023 compared to the same periods in 2022. Some analysts reasoned that fierce competition from discount retailers such as T.J.Maxx and internet retailers such as Amazon has continuously stolen revenue from Macy’s.

Despite a decline in sales, Macy's significantly improved its gross margin rate, reaching 40.3% in the third quarter of 2023, an increase of 160 basis points from the same period in 2022. In the fourth quarter, the gross margin rate was 37.5%, up 340 basis points year-over-year.

For its full-year adjusted EPS, Macy's now expects a range of $2.88 to $3.13, a narrower estimate compared to the previous projection of $2.70 to $3.20. This indicates higher profit expectations for the fourth quarter than what Wall Street had anticipated.

Macy's has sought new avenues for growth as it works to revitalize its legacy brand. With sales at its traditional mall stores lagging, the company announced in October that it plans to open up to 30 smaller stores in strip malls over the next two years. Additionally, it has updated some of its private labels and introduced new ones, such as the women's clothing brand On 34th.

The company's strongest sales have come from its higher-end department store chain, Bloomingdale’s, and its beauty chain, Bluemercury.

Overall, on an owned-plus-licensed basis, Macy's reported a same-store sales decline of 6.3%, better than the 7.75% drop expected by analysts.

On an owned basis, Bluemercury achieved comparable sales growth of 2.5%, while Bloomingdale’s experienced a 3.2% decline. The main Macy's brand saw a comparable sales decrease of 7.6%.

Lower permanent markdowns on merchandise helped boost the company’s gross margin to 40.3% from 38.7% a year earlier. Merchandise inventories fell 6%. Lower permanent markdown itself refers to the strategy of reducing the frequency or depth of permanent price reductions on products. Retailers often use this approach to preserve profit margins and avoid devaluing their brands. Instead of offering significant and frequent discounts, companies might focus on better inventory management, improved forecasting, and creating a sense of exclusivity around their products to minimize the need for deep price cuts.

In light of these challenges, Macy's is focusing on strategic initiatives like "A Bold New Chapter," which aim to reposition the company, enhance the customer experience, and unlock shareholder value. This includes investing in digital transformation and improving shopping experiences across all three nameplates (Macy's, Bloomingdale's, and Bluemercury).

IV. Industry Problems

This challenge extends beyond Macy's and is being experienced by other retailers as well. The impact has been particularly pronounced for luxury retailers like Macy’s, Nordstrom, and Kohl’s, highlighting that this is an industry-wide issue rather than one specific to Macy's. Conversely, discount retailers have benefited from recent macroeconomic developments, as rising interest rates have pressured consumers, making their lower prices more appealing than those of luxury retailers.

To combat the market slowdown, Macy’s decided to launch its online commerce business. The history of Macy's with online retailing goes back to 1998 when the full online store, Macy's.com, was planned to launch in October 1998. This move was part of Federated Department Stores' strategy to take advantage of the Internet's growing importance in consumer shopping. Over the next decade, Macy's shifted towards an omnichannel strategy, aiming to provide a seamless shopping experience across both online and offline channels. This included using its physical stores as distribution centers for online orders, reducing inventory costs, and improving delivery times. The company introduced click-and-collect services, allowing customers to purchase items online and pick them up in-store, eliminating shipping costs and delays.

However, in September 2022, Macy's launched a curated digital marketplace on macys.com, featuring a wide assortment of new brands, merchandise categories, and products from third-party merchants and brand partners. This marketplace was powered by Mirakl, an enterprise marketplace technology company, and customized by Macy's digital, merchant, and technology teams.

The marketplace saw significant growth in its first quarter, with gross merchandise value increasing by over 50% compared to the fourth quarter of 2022. The average order value and units per order for marketplace customers were also 50% above those not shopping at the marketplace. As a result, without significantly increasing advertising expenses, Macy’s was able to grow its e-commerce sales more than its brick-and-mortar competitors such as kohls.com, nordstrom.com, and jcpenney.com.

The seemingly successful endeavor of Macy’s in online business has sparked the question: Does Macy’s still need its offline presence? Should Macy’s start reducing its offline assets and focus more on advertising its products online? How would an activist view this opportunity?

V. Activists on Macy’s

In December 2023, investment firms Arkhouse Management and Brigade Capital Management made a bid to take Macy’s private at $5.8 billion ($21 per share). In February 2024, they increased their offer to $24 per share, valuing the company at $6.3 billion. Subsequently, in June 2024, they raised their bid to $24.80 per share, valuing the company at $6.9 billion. Despite these efforts, Macy’s ultimately ended talks with the activist investors due to concerns over the financing arrangements and the lack of a compelling value proposition.

There are a few angles that these activists have about Macy’s:

Undervaluation: They believe that Macy’s shares are undervalued and that the company has significant potential for growth. By acquiring a substantial stake, they aim to unlock this potential and increase the stock price.

Operational Improvements: Activist investors often identify areas where a company can improve its operations, such as streamlining processes, reducing costs, or enhancing profitability. Macy has been pushing for a turnaround strategy that includes store closures and a focus on upscale brands like Bloomingdale’s.

Strategic Acquisitions: By taking Macy’s private, activist investors hope to implement a more aggressive acquisition strategy, potentially integrating Macy’s with other retail chains or brands to create a more competitive entity.

Board Influence: Activist investors often seek to influence the company's board of directors to ensure their interests are represented. This can involve nominating new board members who share their vision for the company’s future.

One potential turnaround strategy that activists could push is to break up Macy's assets and allow the company to concentrate on expanding its online presence. Activist investors could then benefit from quickly selling Macy's assets for cash. Ultimately, Macy's is a retail company, not a real estate company. However, what would be the right reason for pursuing this strategy?

VI. To break up or not?

When comparing Macy's property value and enterprise value with other real estate investment trusts, we can gain insight into how effective Macy's is at monetizing its retail activities through its ownership of fixed assets. In Q1 2024, Macy's property value was $13.6 billion, which was higher than its enterprise value of $11.1 billion. However, most other real estate trusts had enterprise values higher than their property values, with the exceptions of Hudson Pacific and Cousins Properties. Interestingly, Macy's has a brand value that should be factored into the enterprise value calculation but still needs to be reflected in its current EV. This leads to the hypothesis that there is potential value to be unlocked by Macy's management, suggesting that its enterprise value should be higher than its property value.

Additionally, when we consider Macy's unlevered free cash flow (FCF), which is a gauge of how well a business generates its cash flow, we see that Macy's is still producing positive FCF. However, there has been a decrease in FCF in the last twelve months of 2023 due to capital expenditures. Nevertheless, Macy's return on equity (ROE) remains healthy at 18%, indicating that the company has been able to generate positive returns from its retail activities. This suggests that there may still be unrealized value in the company, and Macy's management has the opportunity to wait for the right partners to further enhance the business.

VII. Conclusion

In conclusion, Macy's is navigating a complex retail landscape, balancing the challenges of a changing market with the potential for growth through strategic initiatives. Despite recent activist interest and suggestions to unlock value through asset sales or going private, Macy's remains committed to a turnaround strategy focused on enhancing its brand, investing in digital transformation, and exploring partnerships. While the future of retail is uncertain, Macy's history of innovation and resilience suggests that it is well-positioned to adapt and thrive in the years to come. Whether it chooses to leverage its real estate assets, focus on its online presence, or pursue strategic acquisitions, Macy's holds the potential to create significant value for its shareholders and continue its legacy as an iconic American retailer. The company's strategic patience in seeking the right partners and opportunities amidst improving market conditions underscores its commitment to thoughtful and impactful decision-making, setting the stage for a brighter future.