Five Below Inc (FIVE): In A League of Its Own

FIVE offers a unique investment opportunity in the retail sector, combining a distinct "treasure hunt" shopping experience with strong financial performance and aggressive store expansion.

This information is based on sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the author and are subject to change without notice.

You are advised to discuss your investment options with a qualified financial advisor to determine if any investment is suitable for your specific needs and risk tolerance.

Disclosure:

- I may hold positions in the securities covered in the articles on this website.

- Past performance is not indicative of future results.

- All investments involve risk, including the potential loss of principal.

Please note that this disclaimer is not a substitute for personalized financial advice and should not be considered a recommendation to buy or sell any security.

I first found out about Five Below Inc. when walking to a coffee place in Midtown Manhattan. At first, I was unsure if this store sold cold clothes or frozen food. The supposed letter “O” looks like a degree sign to me. But because it was already December and I had already bought my winter jackets, I figured I’d pass and continue walking to the coffee place to meet my friend.

Be honest with me: For non-US citizens, how many of you think the same if you see a name sign like the one above?

Never do I think that it is a dollar store!

Fast-forward to today. FIVE got onto my radar after the price performed badly over the past few months. To give you some perspective, the other usual comparables for FIVE are Dollar Tree and Dollar General, which are not doing well either. But later, I will reveal why I favor FIVE over the others.

All three players have suffered a massive drop since three years ago, with DG suffering a -65% decrease in share price from the peak, while DLTR and FIVE fared better with -52% and -56%, respectively.

In my view, one culprit was a mismatch in investors’ expectations. Many regard FIVE as a growth stock, with which I disagree entirely.

FIVE stocks were indeed experiencing a high price-to-earnings (P/E) ratio. According to historical data, Five Below's P/E ratio was significantly higher in the past, with values of 88.8 in 2020 and 44.0 in 2021. This elevated P/E ratio likely reflected investors' optimistic expectations for the company's growth and expansion potential. High P/E ratios are often associated with growth stocks, where investors anticipate strong future earnings despite current valuations that may seem high relative to present earnings.

In Five Below’s case, that is not the case. The company's recent performance has been marked by disappointing comparable store sales, with guidance for Q2 2024 indicating a 6-7% decrease. This decline in sales has been accompanied by a reduction in earnings forecasts, with the Q2 EPS guidance lowered from $0.57-0.69 to $0.53-0.56. These operational challenges have been further compounded by margin pressure, as evidenced by a contraction in EBIT margins of approximately 250 basis points over the past two years.

Adding to the company's woes, Five Below has faced strategic issues that have shaken investor confidence. The abrupt departure of CEO Joel Anderson in July 2024 introduced uncertainty about the company's future direction. Analysts have pointed to merchandising missteps, suggesting that Five Below has "incurred a lot of self-inflicted wounds" and needs to refocus on "trend right" goods and strong value. The company's decision to raise prices on core products and introduce higher-priced items may have compromised its value proposition, alienating its core customer base.

The financial impact of these challenges is reflected in Five Below's valuation metrics. The company's P/E ratio has dropped significantly from 42.9 at the end of 2022 to 18.918 currently, indicating a substantial shift in investor expectations. As of November 25, 2024, the stock price has fallen to $86.92, well below its 52-week high of $216.18. This dramatic decline underscores the market's reassessment of Five Below's growth prospects and its challenges in the current retail environment.

And the market punishes FIVE hard. But then, things turned around in Q3 2024 for FIVE.

Five Below Inc (FIVE) delivered a strong performance in the third quarter, reporting a 15% increase in sales to $844 million, surpassing its guidance. The company achieved a record milestone by opening 82 new stores during the quarter, driving an 18% growth in its store count compared to the previous year. Sales improved across various categories, with notable gains in tech, seasonal, style, and candy. The introduction of fresh and trend-right products, particularly in beauty, Halloween, tech, games, and toys, played a significant role in the company’s sales outperformance.

Will this be sustainable in the long run? What is a company's moat in this crowded space?

I like to structure my analysis by following FIVE's customer journey. Many people doubt FIVE's future, seeing it as just another dollar store. However, looking more closely at the experience offered, we can see that it is different. Let’s dive in!

1. FIVE is in a league of its own compared to DG and DLTR

Unlike Dollar General or Dollar Tree, Five Below has positioned itself as a fun, engaging destination that appeals to young people with discretionary income. It’s essentially one of the last brick-and-mortar toy stores in the U.S., but with a twist—its low prices and constantly changing inventory create an experience more akin to a treasure hunt. Where other dollar stores or even big-box retailers like Target often cater to adults looking for bargains, Five Below targets kids, teens, and young adults, reinforcing its niche as a “cool,” low-cost retailer. This brand moat is powerful, especially in today’s market where standing out can be a challenge.

While many investors sometimes put DG and DLTR alongside FIVE, I vehemently disagree with that view.

2. A Barrier Against Online Competition

Another key strength is how Five Below naturally protects itself from online competition. Its low-price model creates a barrier for e-commerce giants like Amazon or Temu, as many of its products fall below the so-called “shipping price floor.” Simply put, it’s not profitable for online retailers to ship a $1 candy bar, for instance. While online stores might sell cheaper goods in bulk, Five Below sidesteps this by offering single items at a lower nominal price—something kids and teens care about more than the value-per-unit that adults might prioritize.

3. Following the Recipe of TJ Maxx and Ross

The "treasure hunt" shopping experience is another of Five Below’s secret weapons. Like off-price retailers like TJ Maxx or Ross or Macy’s Backstage, the company thrives on impulse buying. Most customers don’t walk into Five Below looking for something specific; instead, they’re drawn to the constantly updated, trendy inventory. This is tough to replicate online, especially for Five Below’s mix of seasonal, tech, and novelty products. Social media buzz, from YouTube hauls to Instagram trends, also underscores how much appeal these products have across different age groups.

There is a good implication from this perspective. Because of the similar experience offered, I believe it is better to compare FIVE’s valuation multiple with that of Ross and TJ Maxx rather than Dollar General and Dollar Tree. You’ll see what I mean when looking at the table below.

FIVE’s price-to-earnings (PE) ratio, based on the trailing twelve months (TTM), is 23.3x, which is closer to that of TJX at 29.7x and ROST at 24.62x, rather than to DLTR and DG. I generally agree with these valuations, considering the differences in customer demographics between DG and DLTR. Many of their customers are primarily deal hunters from low-income segments. In contrast, ROST and TJX target consumers who can still afford branded products at discounted prices. Additionally, while DG and DLTR emphasize their $1 (or $1.25) items, FIVE is more willing to sell items priced at $5 or even higher, especially with the introduction of Five Beyond.

4. Firing on All Cylinders

When it comes to growth, Five Below is firing on all cylinders. They’re opening stores aggressively—82 new locations last quarter alone—with a decent return on invested capital (ROIC). Their ambitious target of 3,500 stores might raise eyebrows, but consider that Dollar General currently operates around 20,000 stores nationwide. A quick glance at a map shows clear opportunities for expansion, particularly in regions like the Pacific Northwest. While concerns over same-store sales growth have surfaced, it’s worth noting that Five Below’s numbers outpaced competitors by 2% last year, and their efforts to address shrink (like reverting to in-person checkouts) seem straightforward and actionable.

5. Robust Financials

Five Below's financial health remains robust, with adjusted earnings per share of $0.42, significantly outperforming the forecast of $0.17. The company's gross margin improved by approximately 290 basis points to 33.2%, primarily due to lapping the shrink true-up from the previous year and timing of certain product margin benefits. Despite facing headwinds in selling, general, and administrative expenses, which rose to 25.5% of net sales, Five Below managed to increase its adjusted operating margin by approximately 110 basis points to 3.3%.

Looking ahead, Five Below has updated its fiscal 2024 guidance, expecting net sales growth between 9% and 10%, projecting to reach $3.84-$3.87 billion. The company plans to open approximately 227 new stores by the end of fiscal 2024, bringing the total store count to 1,771. However, in a strategic shift, Five Below plans to moderate its store growth to 150-180 stores in 2025, focusing on improving existing store performance and addressing execution issues. This decision reflects a prudent approach to balancing expansion with operational efficiency in a challenging retail landscape.

Gross margin, operating margin, and net margin have remained stable over the years at approximately 35%, 9%, and 7%, respectively. This indicates that FIVE does not compromise its margins in pursuit of expanding its top and bottom lines. Additionally, the three-year revenue growth rate stands at 22.3%, while the three-year earnings per share (EPS), adjusted for non-recurring income, is at 35%. With significant potential for growth, it will be exciting to see how FIVE leverages its advantages to expand further while maintaining a low cost profile.

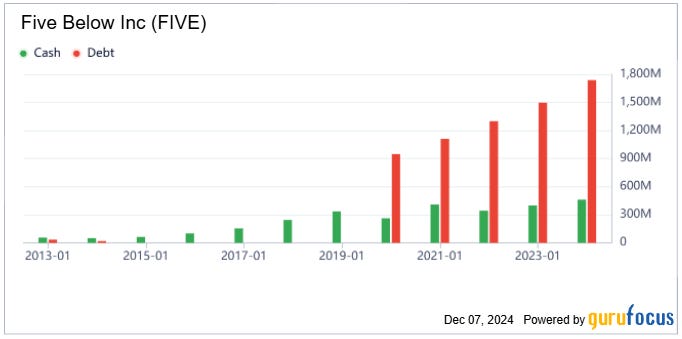

Risk: Debt, Tariffs, and A Slowdown in Spending

In terms of competitive advantage, I am favorable towards FIVE, but there are still aspects I find challenging to understand. The accumulation of debt over the past five years could pose a problem if the company does not manage its commitments effectively. The debt-to-EBITDA ratio of 3.9 seems somewhat stretched. However, management has thus far handled the situation well, utilizing the debt effectively, as indicated by a Return on Invested Capital (ROIC) that exceeds the Weighted Average Cost of Capital (WACC).

Tariffs and a slowdown in unnecessary spending are interconnected economic factors that can significantly impact consumer behavior and retail businesses like Five Below.

Tariffs on imported goods can increase retailers' costs, potentially forcing them to raise consumer prices. For a company like Five Below, which relies heavily on imported products to maintain its low-price strategy, tariffs pose a significant challenge. According to the National Retail Federation, the proposed tariffs could lead to price increases of 12.5% for apparel, 18.1% for footwear, and up to 55% for toys. These price hikes could directly affect Five Below's ability to maintain its $1-$5 price points, potentially eroding its core value proposition.

As prices rise due to tariffs, consumers may respond by reducing their discretionary spending. The NRF projects that the proposed tariffs could reduce American consumers' spending power by $46 billion to $78 billion annually. This reduction in spending power is likely to disproportionately affect retailers like Five Below, which focus on non-essential items and impulse purchases.

Conclusion

This is what Peter Lynch might call Turnaround, a stock that has been beaten down, hated, or forgotten, with depressed prices. But I have a firm conviction in the company's moat and have been following this stock ever since the drop that occurred after the CEO resigned in July when the market overreacted.

I made several purchases over the months when the stock was still struggling with poor market perception due to lower earnings expectations for Q3 2024, which, conservatively, are lower than the company’s expectations for Q3 2023. Given that news tends to exaggerate situations, I believe that they will be able to turn things around, at least by the Q4 2024 earnings report. I did not expect them to beat the EPS by 148%, perhaps Christmas comes early to FIVE. Nevertheless, I am playing the long game and will continue to monitor how the new CEO can drive the engine of FIVE in the years to come.