Lululemon: Defying the Odds in a Competitive Market

Driven by a winning combination of brand loyalty, product innovation, and strong financials, Lululemon is well-positioned to outperform competitors in the dynamic athleisure industry.

This information is based on sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the author and are subject to change without notice.

You are advised to discuss your investment options with a qualified financial advisor to determine if any investment is suitable for your specific needs and risk tolerance.

Disclosure:

- I may hold positions in the securities covered in the articles on this website.

- Past performance is not indicative of future results.

- All investments involve risk, including the potential loss of principal.

Please note that this disclaimer is not a substitute for personalized financial advice and should not be considered a recommendation to buy or sell any security.

I. Background

In July 2025, Lululemon Athletica (LULU) shares dropped to their lowest level since the spring of 2020. Analysts expressed concerns about the slowing down of the fashion athletic wear market due to a declining retail environment. LULU's growth was primarily driven by the impact of the COVID-19 pandemic in March 2020. By Q2 2024, LULU's stock price had returned to its pre-pandemic levels. The company experienced significant growth during the lockdown period when people were exercising at home.

Following the drop in stock price and with a PE ratio of around 20 (specifically 20.78x), LULU caught my attention.

There are a couple of reasons why this happened on LULU:

Slowing revenue growth: Lululemon's revenue growth rate decelerated significantly, especially in its core North American market. In Q1 2024, overall revenue growth slowed to 10% from 24% the previous year, while North American growth slowed to just 3% from 17%.

Macroeconomic pressures: The declining spending power of the American middle class, coupled with high inflation, led consumers to cut back on non-essential expenses like premium athleisure wear8.

Increased competition: The yoga apparel market saw an influx of competitors, including major brands like Nike and Adidas and newer players like Alo Yoga and Vuori. These brands directly compete with Lululemon, often setting up stores in close proximity.

These reasons then led to guidance cuts on LULU, where it reduced its full-year revenue guidance, which further dampened investor sentiment. These factors combined to create a perfect storm for Lululemon's stock, leading to its significant decline in 2024 and making it one of the worst-performing stocks in the S&P 500 for the year.

II. Origin

In 1998, in the bustling city of Vancouver, Canada, entrepreneur Chip Wilson found himself at a crossroads. After selling his first venture, Westbeach Sports—a company that catered to surfing and skateboarding enthusiasts—he was on the lookout for his next big idea. It wasn’t long before yoga crossed his path, and after trying a class himself, he noticed something that would spark his next venture: the women around him were practicing in outfits that were neither breathable nor stylish. That realization ignited his inspiration to create something new—workout wear that was as functional as it was flattering.

And so, Lululemon was born.

In its early days, Lululemon operated as a dual-purpose space, serving as a design studio by day and a yoga studio by night. By 2000, it opened its first storefront in Vancouver, tapping into the growing demand for yoga apparel. The flagship product? A pair of little black stretchy pants, crafted from a special technical fabric that combined the softness of cotton with the durability needed for athletic wear. These pants were soon embraced not only by yogis but also by runners and athletes from all walks of life, leading Lululemon to expand into a full range of athletic apparel and accessories.

In July 2007, Lululemon went public, raising $327.6 million in its initial offering. Since then, the company’s stock has skyrocketed, growing 13-fold and putting Lululemon in the same competitive league as athletic giants like Nike, Adidas, and Under Armour.

I will skip the detailed information about the stock itself, as I have found several excellent Substack articles that provide a deep dive into Lululemon (LULU). That being said, I want to cover two main topics in this post: my investment thesis and the associated risks.

The work of a financial analyst falls somewhere in the middle between that of a mathematician and of an orator.

- Benjamin Graham

III. Investment Thesis

1. Consistent top-line growth and improving margins

Lululemon has cultivated a powerful brand associated with high-quality, performance-oriented athleisure wear and a community-driven approach. This translates into a loyal customer base willing to pay premium prices, driving strong revenue growth and profitability.

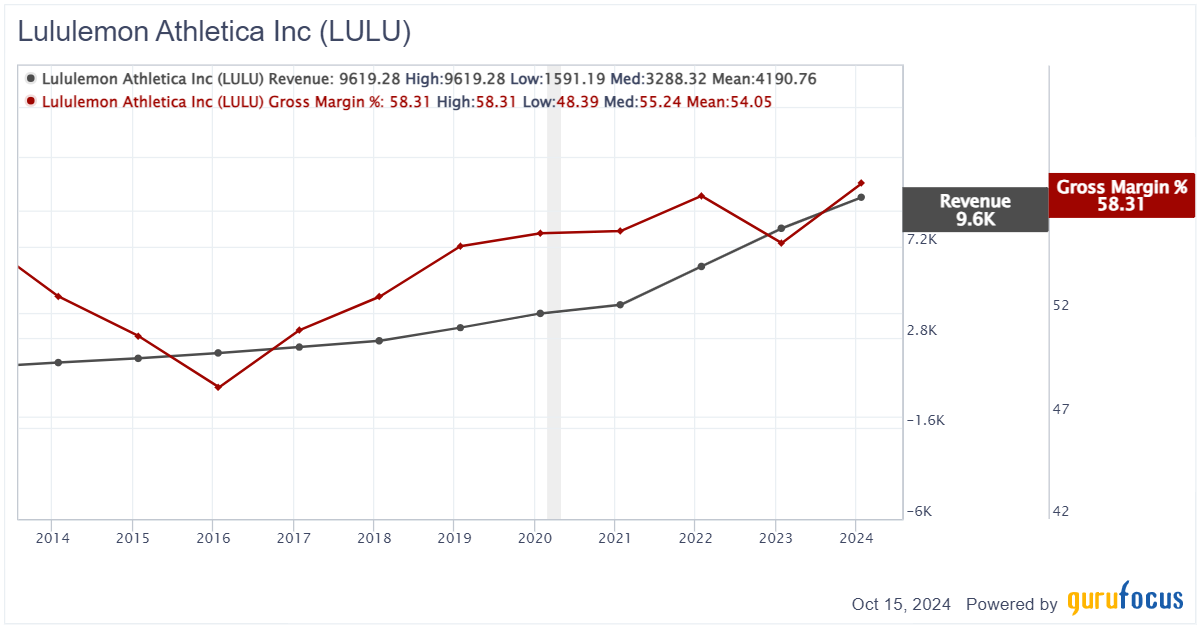

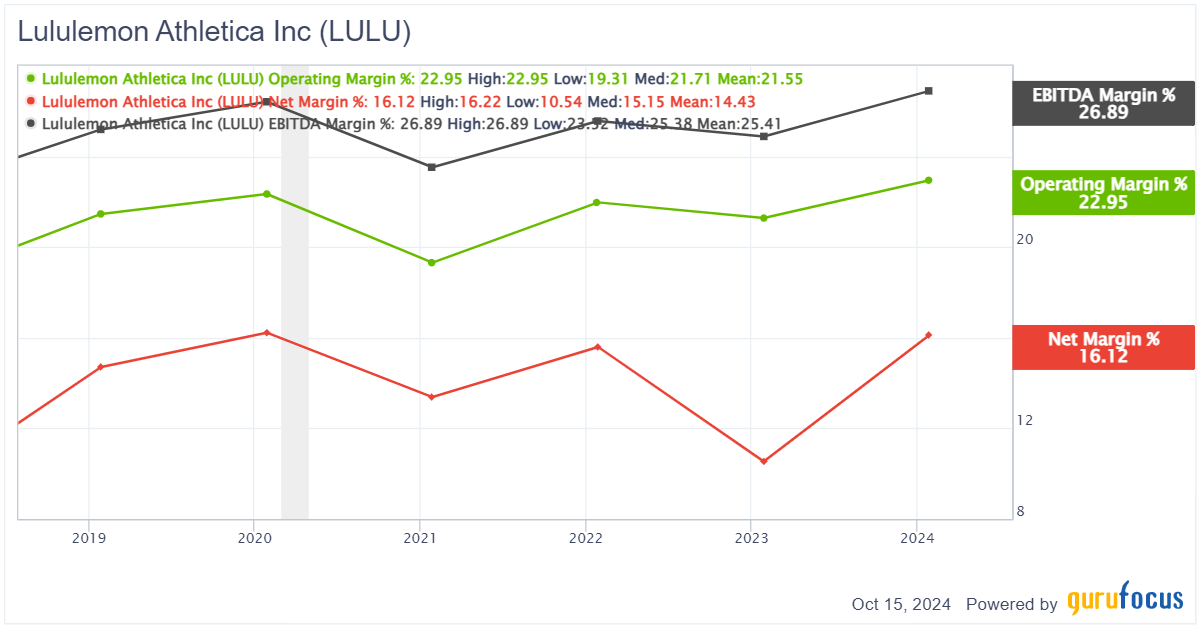

Lululemon's consistent revenue growth (CAGR of 19.80% since 2015), which is above average industry growth of 8.9% by Market Data Forecast, showcases its ability to grow the athleisure market and attract customers through its brand value. In addition, high-profit margins (gross margin of 58.31% ) indicate strong pricing power and brand loyalty, which is much better than the median industry gross margin of 36.9%. The company's focus on community building and customer engagement further reinforces this thesis.

At the Net Margin, LULU also boasts higher margins at 16.34% compared to the industry’s median of 2-3%.

2. Effective management and operational efficiency

Lululemon's management team, led by CEO Calvin McDonald, has demonstrated strong execution and a focus on value creation. The company has consistently improved its operational efficiency, particularly in managing production costs (COGS), contributing to its impressive profitability.

McDonald himself is not foreign to the retail and consumer goods industry. He has demonstrated strong management skills throughout his career, particularly in his role as CEO of Lululemon. Prior to Lululemon, he served as president and CEO of Sephora Americas for five years. At Sephora, he expanded the brand's presence in global markets, including Brazil and Mexico. Furthermore, he also held leadership positions at Sears Canada and Loblaw Companies Limited.

Under McDonald's leadership, Lululemon has achieved significant financial milestones. The company debuted on the Fortune 500 list in 2023, ranking 461st with $8.1 billion in revenue for 2022. Lululemon's revenue has grown by nearly 30% year-over-year.

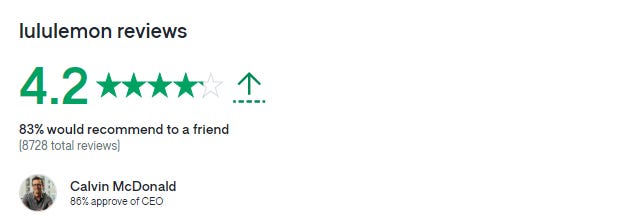

Approval from LULU’s employees also shows that he is the right figure to steer the company back to its glorious days. 86% of LULU employees approve of the CEO, which shows strong support for McDonald to right Lululemon's ship. The data shows a steady decline in COGS as a percentage of revenue, indicating improved production efficiency. The CEO's track record and positive employee satisfaction ratings further support this thesis.

3. Growth opportunities in men's and international markets

While Lululemon has traditionally focused on women's apparel in North America, there is significant potential to expand its men's product line and increase its international presence. Lululemon's management has acknowledged these opportunities and is actively pursuing them.

“Men's is one of our largest and most exciting areas of future growth, both for our current and new guests going forward” - Calvin McDonald, Lululemon CEO

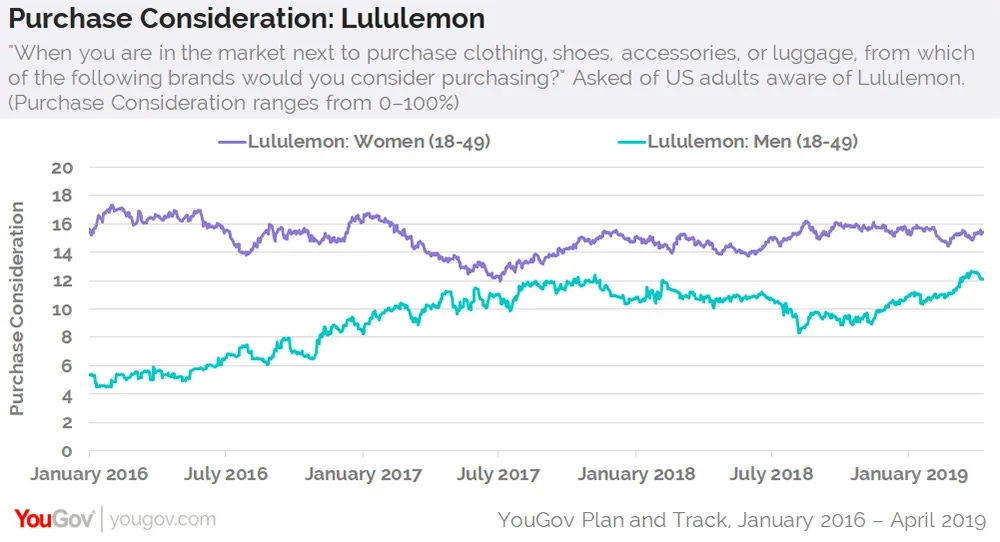

Indeed, purchase consideration among men has more than doubled since 2016. In January 2016, only 5% of US males aged 18-49 who were aware of the brand were open to shopping at Lululemon. By 2024, this percentage had increased to 13%. The growing number of men considered Lululemon a quality brand, especially after it had launched its first global campaign aimed at male consumers.

Knowing a stagnating market in the US, Lululemon is focused on international expansion, especially in the Asia-Pacific region, to drive growth beyond its core North American market. The global athleisure market is expected to grow at a CAGR of 8.9% from 2024 to 2029, reaching $563.43 billion by 2029.

The company aims to quadruple its international revenue by 2026 compared to 2021 levels as part of its "Power of Three x2" growth strategy. International markets, particularly China, are growing much faster than North America. In Q2 2024, China saw 34% year-over-year revenue growth compared to just 2% in the Americas.

China is clearly Lululemon's biggest focus for international expansion and growth potential. As of Q2 2024, China represented 13.5% of Lululemon's overall revenue, making it the largest market outside the Americas. Lululemon plans to expand from 132 stores in China at the end of Q2 2024 to over 220 stores by the end of 2026. The company aims to make China its second-largest market globally. China is the second-largest activewear market in the world, offering significant room for growth as Lululemon builds brand awareness.

4. Steadily increasing cash position and strong FCF

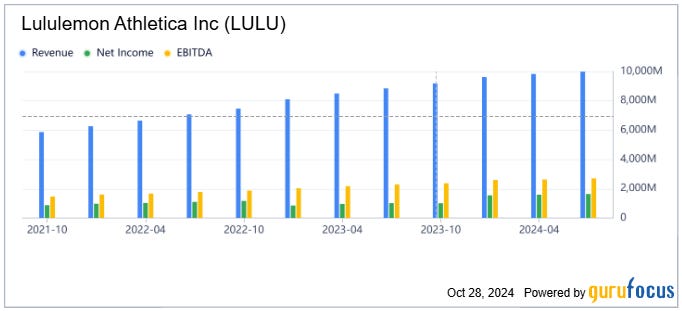

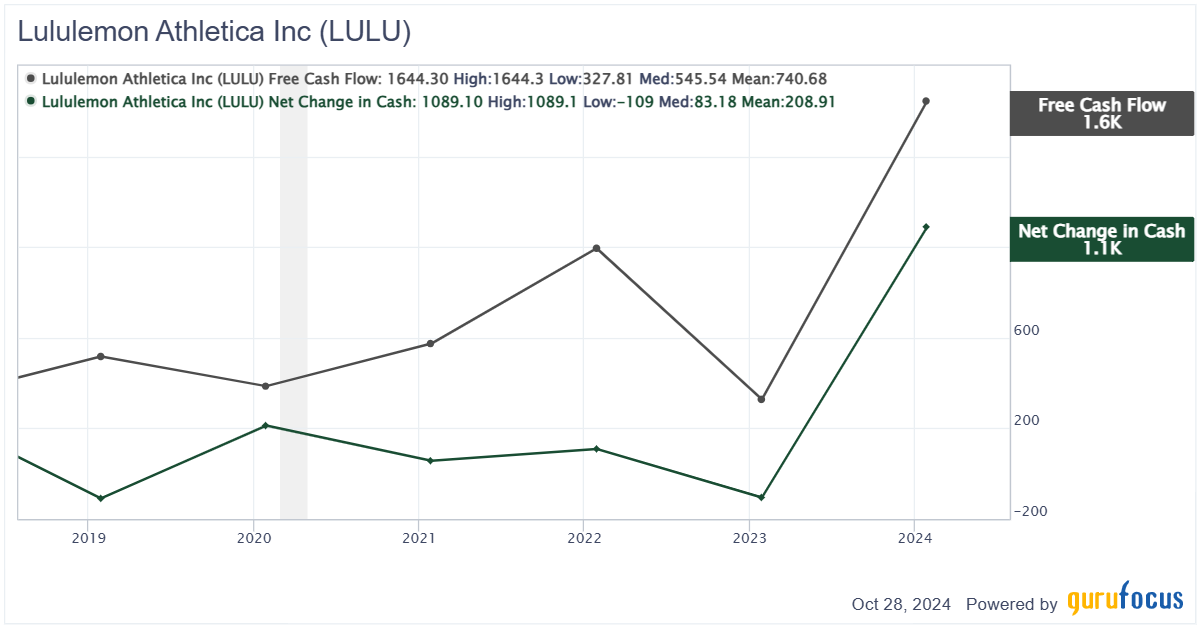

Lululemon's financial position over the past five years, particularly in terms of cash and free cash flow, demonstrates a company with strong financial health and improving operational efficiency.

The company's cash and cash equivalents have shown a steady upward trend, starting at $1.09 billion in 2020 and reaching $2.24 billion by 2024. This represents more than a doubling of the company's cash position over the five-year period. The most significant jump occurred between 2023 and 2024, when the cash position increased from $1.15 billion to $2.24 billion. This substantial increase provides Lululemon with significant financial flexibility, allowing it to potentially fund expansion plans, invest in new technologies, or weather any unforeseen economic challenges.

Lululemon's free cash flow situation is equally impressive, albeit with more year-to-year volatility. In 2020, the company generated $386.27 million in free cash flow. This figure saw consistent growth over the next two years, peaking at $994.61 million in 2022. However, 2023 saw a significant drop to $327.81 million, which could be attributed to various factors such as increased capital expenditures or changes in working capital. The most striking aspect of Lululemon's free cash flow situation is the dramatic increase in 2024, where it reached $1.64 billion - nearly five times the previous year's figure and the highest in the five-year period by a considerable margin.

This robust free cash flow generation provides Lululemon with ample resources to fund its growth initiatives, such as international expansion (particularly in China), product innovation, and digital transformation. It also allows the company to return value to shareholders through stock buybacks, which have been significant in recent years. The company's ability to generate such substantial free cash flow, especially in the most recent year, indicates strong operational efficiency and effective management of working capital.

5. Attractive valuation

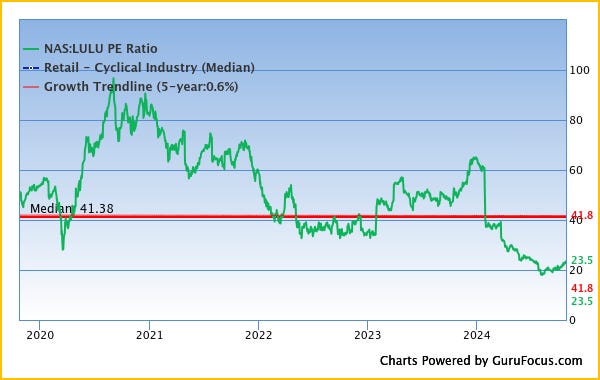

Lululemon's valuation attractiveness has significantly improved following the recent deep dive in its stock price. The company's current price-to-earnings (P/E) ratio of 23.52 is substantially lower than its historical median of 41.30 over the past 13 years. This indicates that the stock trades at a much cheaper valuation than its own history. This places the current P/E closer to the lower end of its 13-year range, fluctuating between 18.25 and 91.62.

When compared to industry peers, Lululemon's valuation appears relatively attractive. Its forward P/E of about 19x is lower than competitors like Nike (27x) and Under Armour (33x), suggesting that Lululemon is comparatively cheaper within the athletic apparel industry. This relative undervaluation becomes even more intriguing when considering Lululemon's strong growth prospects and industry-leading profitability.

Despite a recent guidance cut, Lululemon has demonstrated robust growth, with an average EPS growth rate of 28.10% over the past 5 years and 23.00% over the past 10 years. The stock's attractiveness is further enhanced when this growth is factored in alongside the current P/E ratio. The company's PEG ratio of 0.84 is significantly lower than the industry median of 1.35x, suggesting that LULU’s stock is undervalued considering its growth potential.

The nearly 50% drop in Lululemon's stock price since the beginning of 2024 has dramatically altered its valuation landscape. Before this decline, the stock traded at much higher multiples across various valuation metrics. This significant price reduction has created a potential opportunity for investors, especially considering Lululemon's strong fundamentals and growth prospects.

In addition, when using DCF, we could estimate that using several assumptions listed below, Lululemon’s stock price has a margin of safety of around 16% and resulted in a fair value of $362.16 per share vs. the current share price of $307.25 per share:

Forecasted growth rate: 15%

Terminal growth rate: 4%

Discount rate: 9%

Given that we only use a moderate growth rate of 15% and that Lululemon still has ample room for growth, we feel strongly that the margin of safety for Lululemon’s stock is above 16%.

IV. Investment Risk

1. Slower growth

Lululemon, despite its strong brand and historical growth, faces several significant investment risks that potential investors should carefully consider. One of the primary concerns is the slowing growth in Lululemon's core markets, particularly in the Americas. The company's largest market has shown signs of stagnation, with comparable sales in the Americas declining by 3% year-over-year in Q2 2024. This slowdown is especially pronounced in the U.S., where revenue growth has flattened. This trend raises questions about Lululemon's ability to maintain its impressive growth trajectory in mature markets.

2. Exec departure and unsuccessful product launch

Product innovation and development challenges have also emerged as a significant risk factor. Recent missteps, such as the unsuccessful launch of the Breezethrough leggings line, highlight potential weaknesses in Lululemon's product development process. The departure of Sun Choe, the company's former Chief Product Officer, has further fueled concerns about Lululemon's ability to innovate and maintain its edge in a rapidly evolving market.

The company's success has been built on its reputation for high-quality, innovative products, and any perceived decline in this area could significantly impact consumer loyalty and sales.

3. Geopolitical risk

While China has been a bright spot for Lululemon's growth, with 34% year-over-year revenue growth in Q2 2024, the company's increasing reliance on this market for expansion introduces its own risks. Geopolitical tensions between China and the West, as well as potential economic slowdowns in China, could significantly impact Lululemon's growth strategy. The company's ambitious expansion plans in China also carry execution risks as it navigates different market dynamics and consumer preferences.

Lululemon also faces strong competition from local players, Anta, China’s leading sportswear producer, which reported a 13.8 percent year-on-year increase in revenue to 33.74 billion yuan ($4.73 billion) in the first six months of this year.